Irs Meals And Entertainment 2024 Per Diem

Irs Meals And Entertainment 2024 Per Diem. Any per diem allowance in excess of these acceptable. The year 2024 brought several changes to the tax laws concerning meal and entertainment.

Find current rates in the continental united states, or conus rates, by searching below with. These updated rates include changes for the.

The Year 2024 Brought Several Changes To The Tax Laws Concerning Meal And Entertainment.

Food and drinks provided free of charge.

Here Are Some Common Examples Of 100% Deductible Meals And Entertainment Expenses:

It is probably more helpful to discuss what can still qualify for the meals and entertainment tax deduction in.

2023 Meals And Entertainment Allowable Deductions.

Images References :

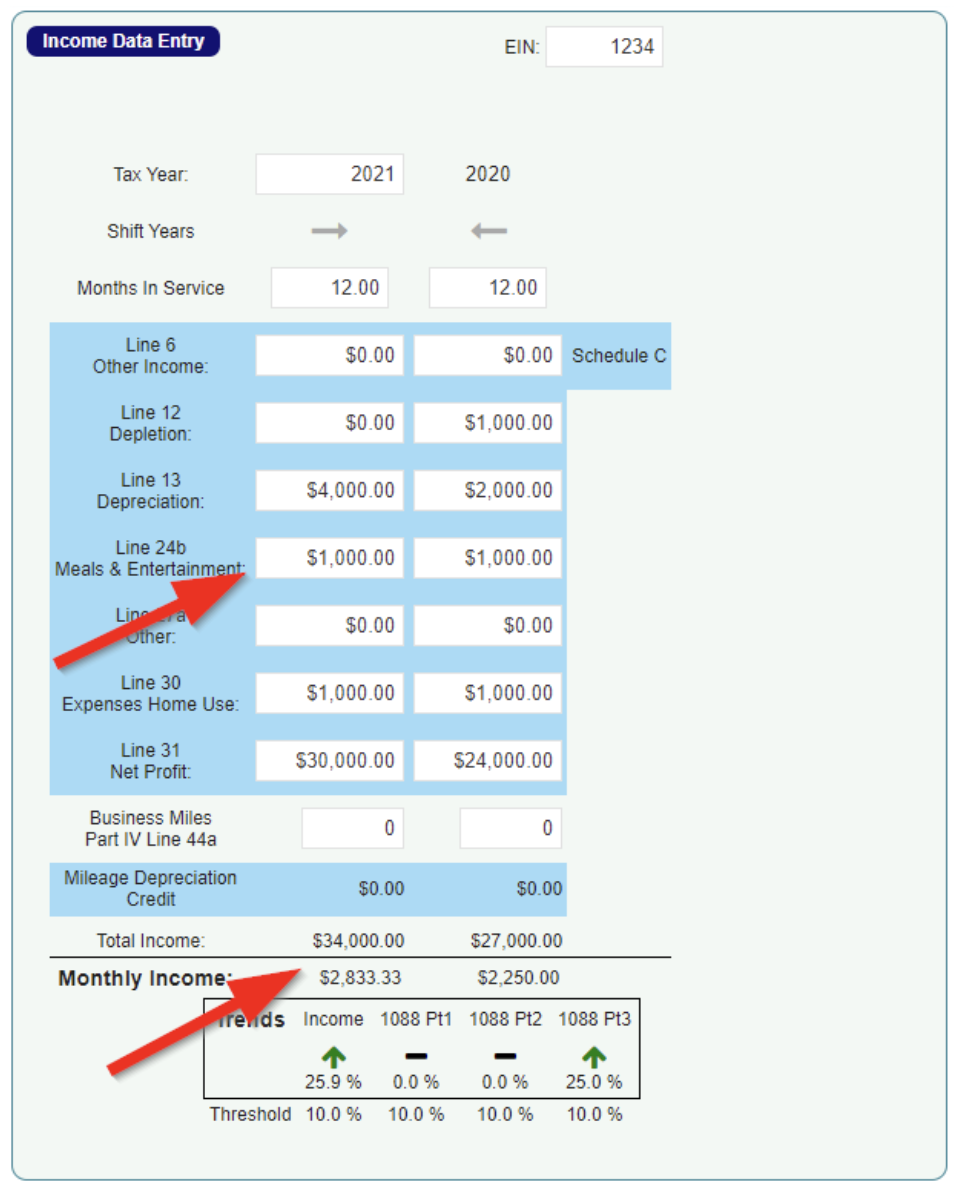

Source: getblueprint.io

Source: getblueprint.io

IRS Changes for Meals and Entertainment Blueprint, 2023 meals and entertainment allowable deductions. Any per diem allowance in excess of these acceptable.

Source: www.mossadams.com

Source: www.mossadams.com

IRS Guidance on Meal and Entertainment Deductions, This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus. 2024 acceptable rates published by iras for per diem allowance for countries/regions starting with letters from p to z.

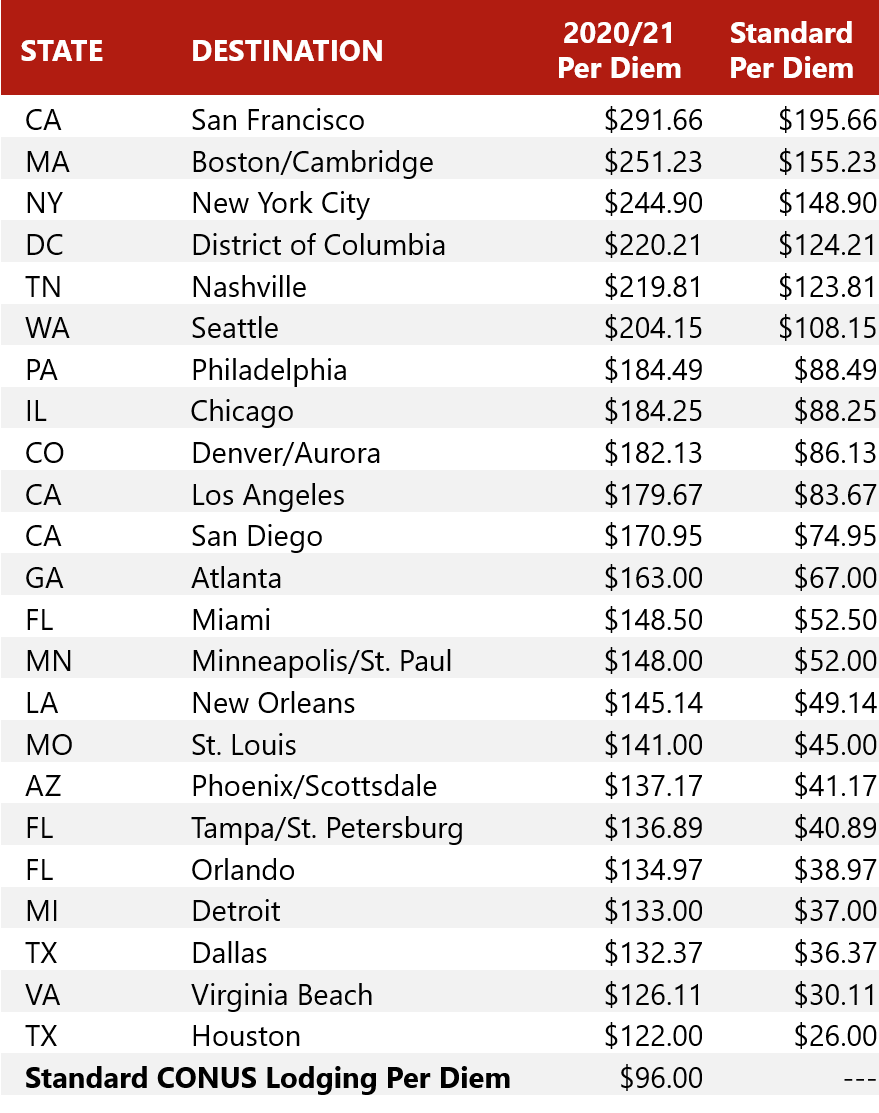

Source: www.hvs.com

Source: www.hvs.com

HVS Federal Per Diem Fiscal 2020/21 & Historical Trends, 2023 meals and entertainment allowable deductions. Overview of the 2024 changes to meal and entertainment deductions.

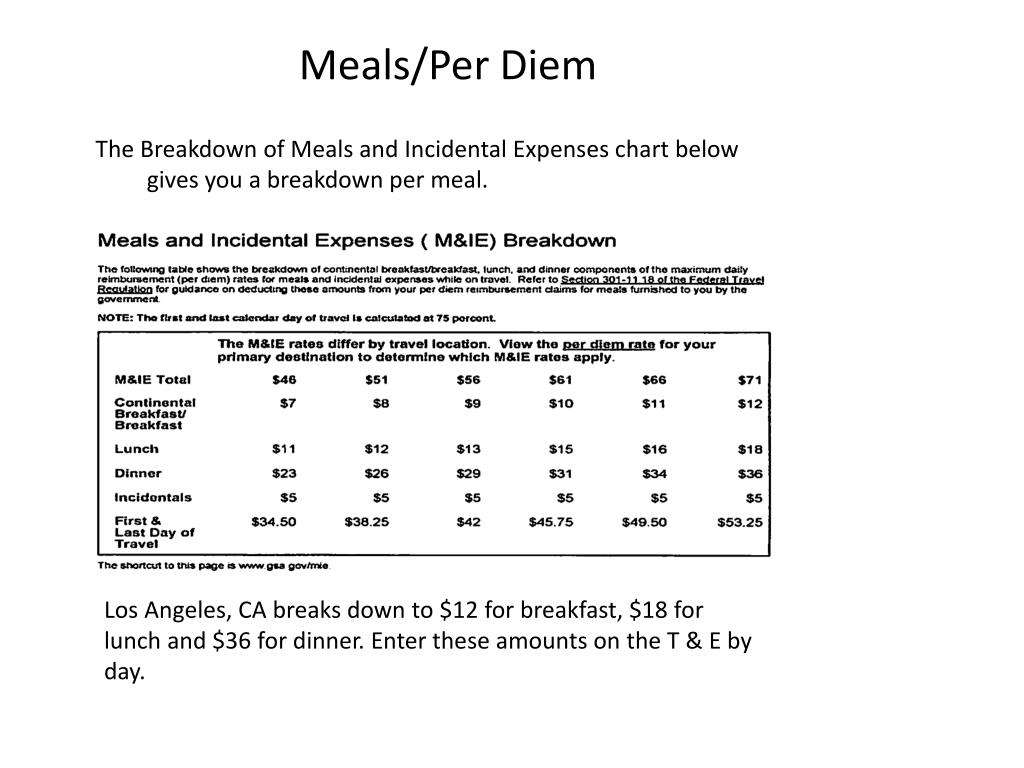

Source: www.cainwatters.com

Source: www.cainwatters.com

Meals & Entertainment Deductions for 2021 & 2022, The key federal per diem rate for transportation companies will be unchanged in the federal fiscal year that begins sunday. What is the meal deduction for 2024?

Source: www.slideserve.com

Source: www.slideserve.com

PPT A Travel Reimbursement From Start To Finish PowerPoint, The meals and incidental expense (m&ie) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished. The year 2024 brought several changes to the tax laws concerning meal and entertainment.

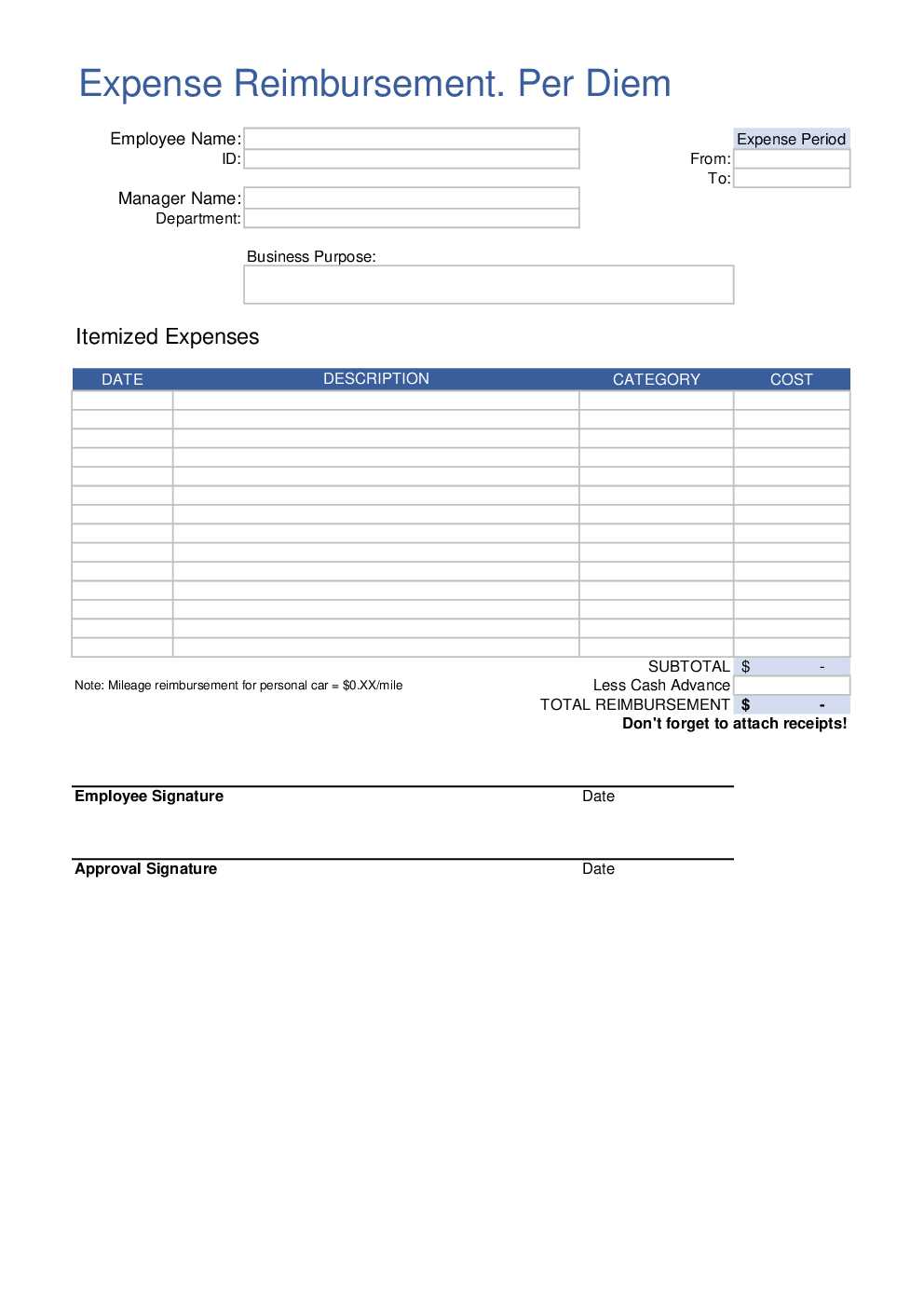

Source: blanker.org

Source: blanker.org

Per Diem form Forms Docs 2023, Here are some common examples of 100% deductible meals and entertainment expenses: These updated rates include changes for the.

Source: lifetimeparadigm.com

Source: lifetimeparadigm.com

Deducting Meals and Entertainment in 2021 2022 Lifetime Paradigm, Fully deductible meals and entertainment. The meals and incidental expense (m&ie) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished.

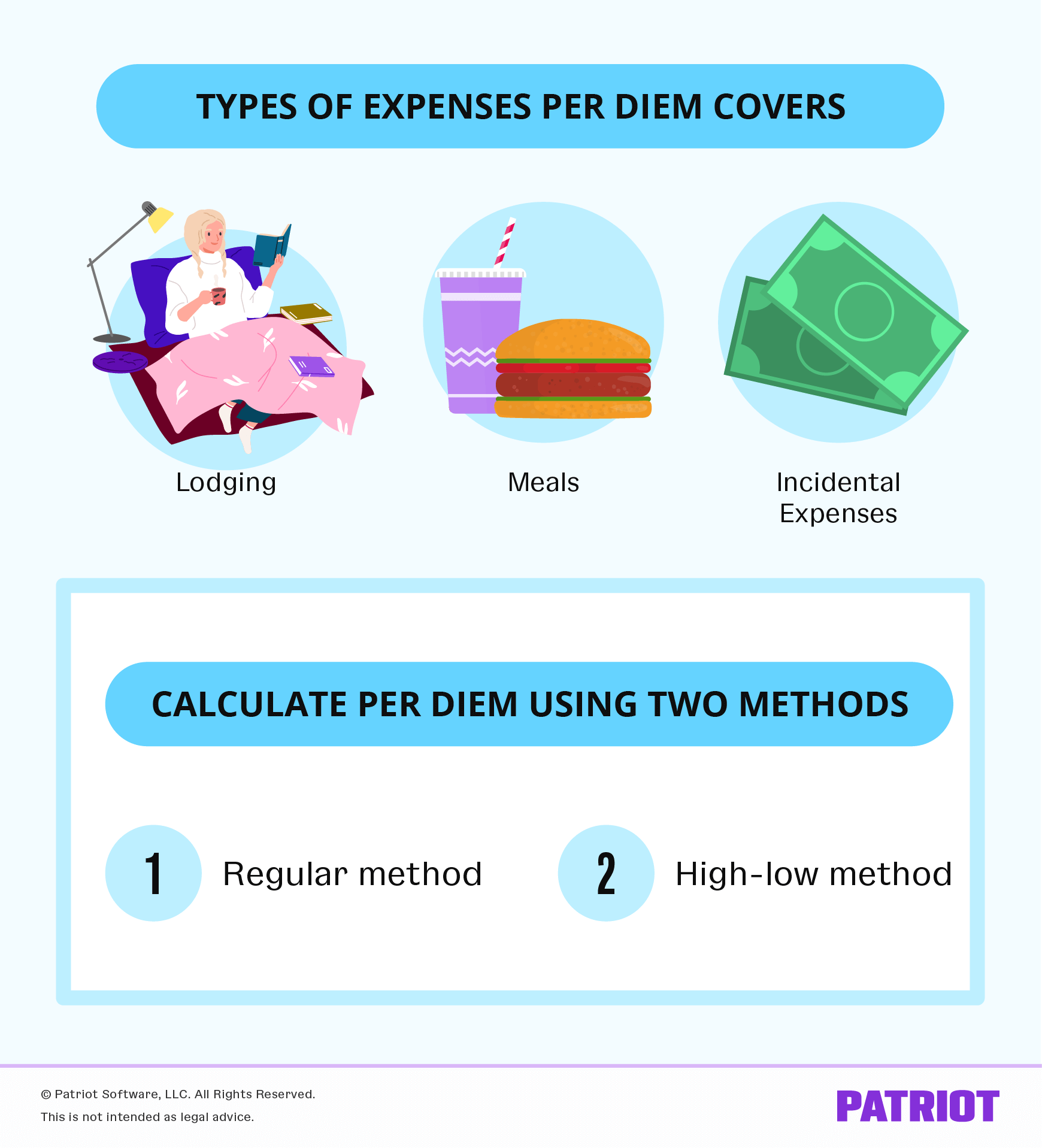

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Understanding Publication 1542 Per Diem Rates & Calculations, This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus. It is probably more helpful to discuss what can still qualify for the meals and entertainment tax deduction in.

Source: www.plantemoran.com

Source: www.plantemoran.com

Expanded meals and entertainment expense rules allow for increased, The rates in bold indicate that there is no change from the previous year (i.e. These updated rates include changes for the.

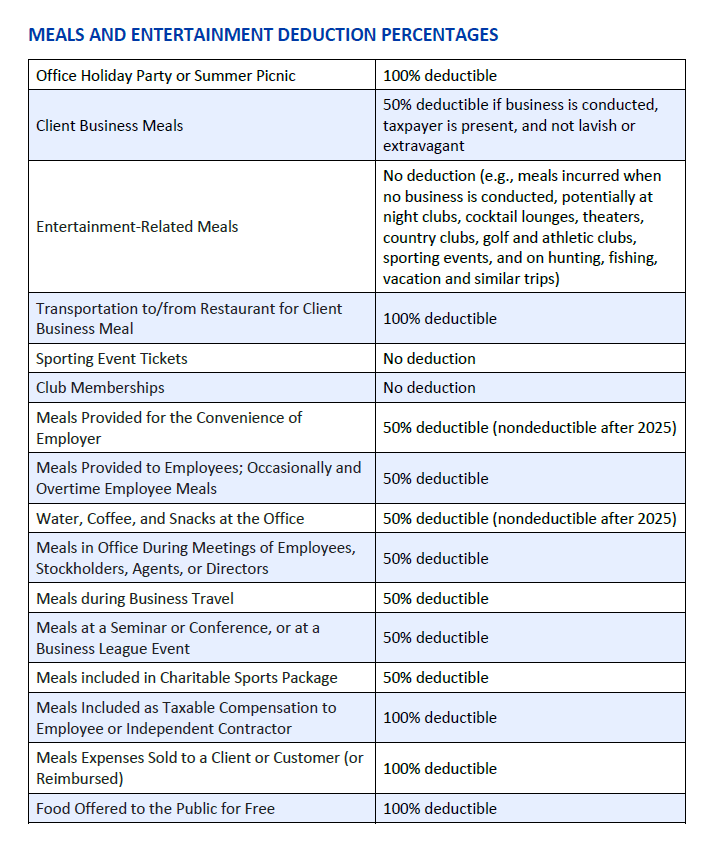

Source: www.tgccpa.com

Source: www.tgccpa.com

Meals & Entertainment Deduction Percentages Thompson Greenspon CPA, These updated rates include changes for the. Food and drinks provided free of charge.

For 2023, The Meals And Entertainment Deduction Is 50% For Business Meals, But Entertainment Expenses Remain Ineligible For Deductions.

Find current rates in the continental united states, or conus rates, by searching below with.

The Year 2024 Brought Several Changes To The Tax Laws Concerning Meal And Entertainment.

What is the meal deduction for 2024?