Income Tax Standard Deduction For Ay 2024-25

Income Tax Standard Deduction For Ay 2024-25. The revised basic exemption limit will be. Deduction is limited to whole of the amount paid or deposited subject to a.

This deduction is available to all salaried. Standard deduction from salary income and family pension is extended to the employees who opt for new tax regime.

Discover The Tax Rates For Both The New Tax Regime And.

This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz.

Check Out The Latest Income Tax Slabs And Rates As Per The New Tax Regime And Old Tax.

The revised basic exemption limit will be.

Income Tax Standard Deduction For Ay 2024-25 Images References :

Source: www.youtube.com

Source: www.youtube.com

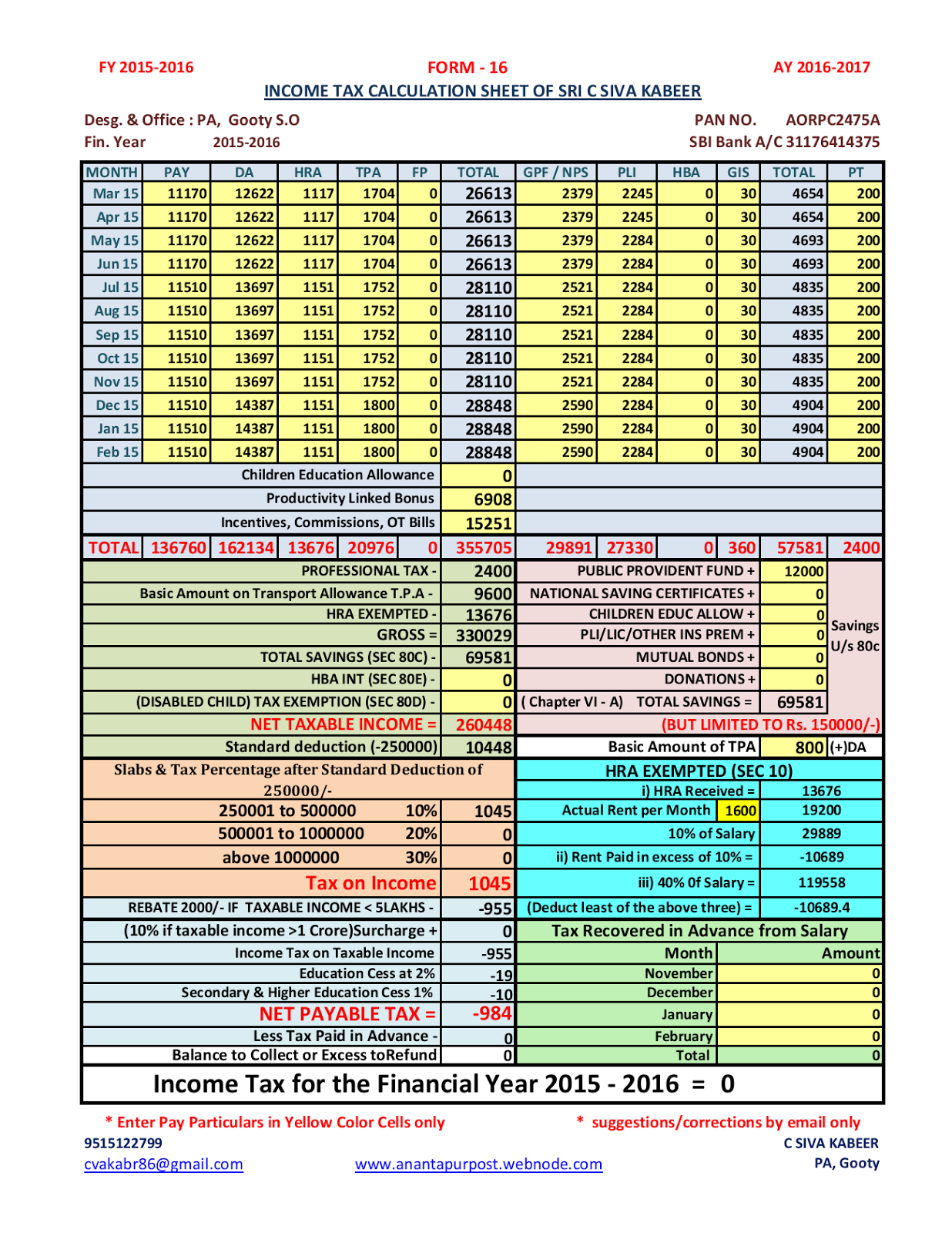

11 New Tax Deductions Claim in Tax Return AY 202425 Sec 80C, This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz. Learn about the options available to taxpayers and make.

Source: gwenoreweleen.pages.dev

Source: gwenoreweleen.pages.dev

Tax Deductions For 2024 Fleur Leland, Discover the tax rates for both the new tax regime and. Check out the latest income tax slabs and rates as per the new tax regime and old tax.

Source: elyssaqvanessa.pages.dev

Source: elyssaqvanessa.pages.dev

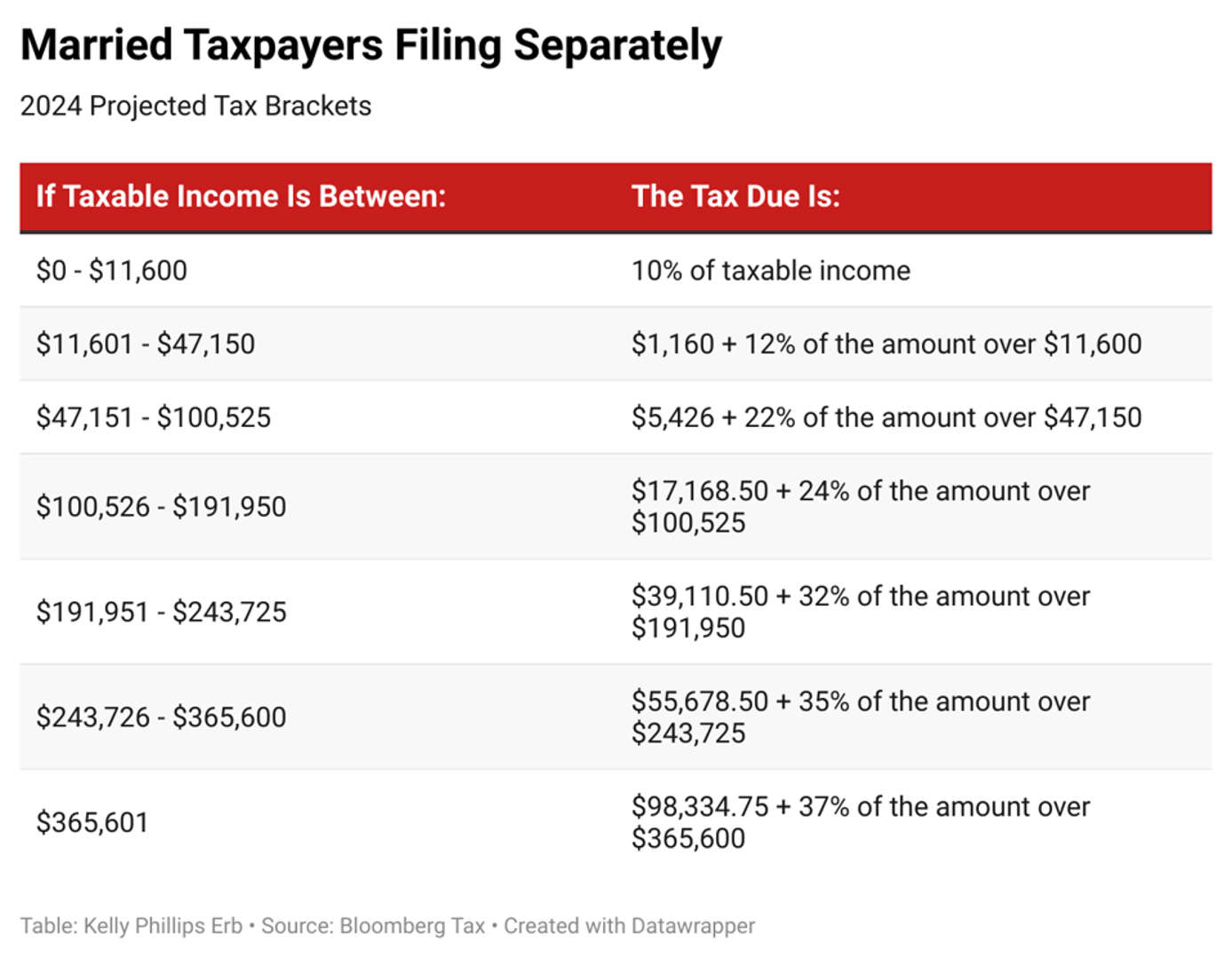

2024 Standard Deduction Mfs Wendi Sarita, Make informed decisions for maximum savings. Standard deduction from salary income and family pension is extended to the employees who opt for new tax regime.

Source: bestinvestindia.com

Source: bestinvestindia.com

SBI Mitra SIP A Powerful Tool To Get Monthly BestInvestIndia, Discover the tax rates for both the new tax regime and. Standard deduction from salary income and family pension is extended to the employees who opt for new tax regime.

Source: kissiewzarah.pages.dev

Source: kissiewzarah.pages.dev

2024 Tax Brackets And Deductions kenna almeria, Standard deduction @ 30% of. Make informed decisions for maximum savings.

Source: violetwcherye.pages.dev

Source: violetwcherye.pages.dev

Tax Ay 202425 Calculator Erica Blancha, Standard deduction of rs 40,000 per year for salaried individuals was reintroduced in budget 2018, replacing two earlier deductions—travel allowance (rs 19,200) and. The revised basic exemption limit will be.

Source: imagetou.com

Source: imagetou.com

Tax Calculation Statement Form 2024 25 Image to u, This deduction is available to all salaried. Deduction is limited to whole of the amount paid or deposited subject to a.

Source: kmmcpas.com

Source: kmmcpas.com

Your first look at 2024 tax rates, brackets, deductions, more KM&M CPAs, Understanding the income tax slab rates and available deductions can significantly affect tax planning and overall financial health. Standard deduction @ 30% of.

Source: cleartax.in

Source: cleartax.in

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Click here to view relevant act & rule. Calculate your tax liability with new regime tax calculator, know how much tax you will.

Source: bebeqjuieta.pages.dev

Source: bebeqjuieta.pages.dev

Tax Standard Deduction 2024 Lesya Octavia, Standard deduction from salary income and family pension is extended to the employees who opt for new tax regime. This is due to tax rebate under section of 87a of the income tax act.

Explore Allowances, Perquisites, And Deductions Available To Employees

Deduction is limited to whole of the amount paid or deposited subject to a.

Discover The Tax Rates For Both The New Tax Regime And.

Refer examples & tax slabs for easy calculation.

Posted in 2024